Down 50% Since Its 2021 Peak – Is Disney a Buy?

Down 50% Since Its 2021 Peak – Is Disney a Buy?

Down 50% Since Its 2021 Peak – Is Disney a Buy?

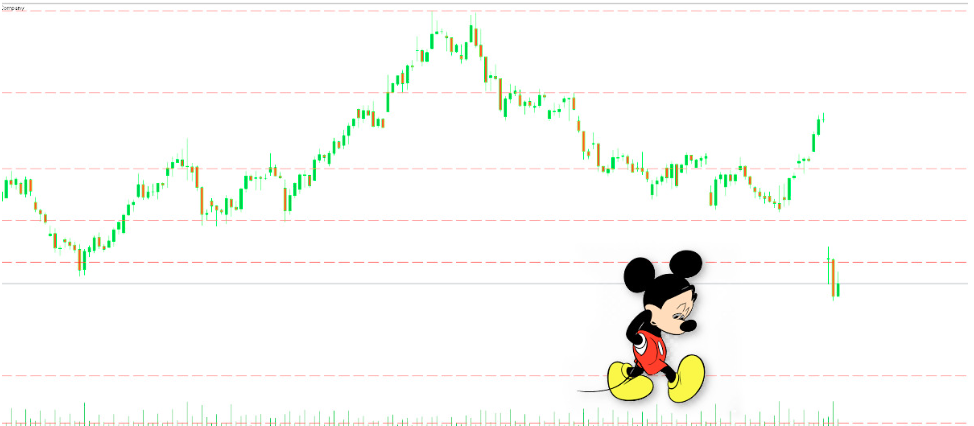

As Disney (NYSE: DIS) prepares to release its earnings on Thursday, October 14th, many investors are wondering: is now the time to buy Disney at a 50% discount from its 2021 peak? Since reaching an all-time high of $203 per share in 2021, Disney's stock has struggled, hitting a low of $84 earlier this year. Despite its challenges, Disney’s brand power remains undeniable, raising the question of whether this price drop presents an attractive entry point.

The Ups and Downs of Disney’s Recent Performance

Disney has faced a series of setbacks, from the impact of the COVID-19 pandemic on its theme parks and the temporary suspension of its dividend in 2020, to recent park closures due to hurricanes in Florida. Although Disney resumed dividend payments in January 2024, these disruptions have impacted revenue streams, adding pressure to its stock performance.

Financial Turnaround on the Horizon?

Investors will be closely watching Disney’s earnings release to gain insights into its efforts to stabilize revenue and fuel growth. Key areas of focus will likely include Disney’s streaming service strategy, theme park recovery, and efforts to leverage its extensive content portfolio. A strong earnings report could signal a turnaround, while disappointing results may extend the challenging period for Disney’s stock.

Is Disney’s Brand Value Enough?

Even amid financial challenges, Disney's brand power is unmatched. From its iconic theme parks to its portfolio of beloved characters and franchises, Disney holds assets that few companies can rival. This enduring appeal could make it a compelling long-term investment, especially for those willing to weather near-term volatility.

Should You Consider Buying Disney at a Discount?

With Disney’s stock currently trading at a significant discount from its highs, long-term investors might see this as an opportunity to buy a blue-chip stock at a lower price. However, it’s essential to consider Disney’s current challenges and whether you believe its growth strategies will restore the company’s former momentum.

In summary, Disney’s current price might be an appealing opportunity for investors looking to add a powerhouse brand to their portfolio. As the company works through its obstacles, the upcoming earnings report may provide valuable insight into Disney's path forward.

Trading Considerations

Wait for the earnings announcement

Sell a 120/125 Vertical Call

Or

Sell a 80/75 Vertical Put Spread

Those Wanting to own Disney sell Cash Secured Puts at $88 or below

The trading opportunities mentioned are informational and not intended as personal financial advice, conduct your own due diligence, all trades involve risk, there is no guarantee of ROI, a potential loss of capital exists with any trade.